Archive for the ‘Entitlements’ Category

Saturday, March 16th, 2024

BIDEN’S $7.3 Trillion Nightmare

Joe Biden’s budget proposal is a campaign pitch that would be disastrous in practice.

by Nate Jackson March 12, 2024

Our first thought when seeing Joe Biden’s $7.3 trillion budget proposal was that he must have transposed the numbers and meant $3.7 trillion. But then we remembered reality and our own warnings from four years ago — that “emergency” COVID spending would create a new floor for federal spending, and there would be no looking back.

When Biden took office, the national debt was $27.7 trillion, but here we are, $34.5 trillion in debt and counting, and all President Fiscal Responsibility wants to do is tax more and spend even more than that.

His budget represents an 18% increase over two years, and he’s proposing massive deficits as far as the eye can see. He wants spending to reach nearly 25% of GDP on federal outlays, which is a major increase over the 21% average of his 50 years in Washington. It’s also a lot more than tax revenue will provide — even at roughly 20% of GDP, which is far higher than the 50-year average of 17.3%.

Biden wants almost $5 trillion in tax hikes, yet that won’t even begin to fund his spending plans. This is the same guy who doubled the deficit last year and then boasted five times in his State of the Union address last week that he had “cut the deficit.” Heck, he’s got the gall to claim this budget proposal cuts the deficit by $3 trillion in 10 years. From what alternate reality?

(more…)

Posted in Administrative State, Big Government, Defense Budget, Democrats, Dept of Defense, Election 2024, Entitlements, Government Waste and Fraud, Joe Biden, Kamala Harris, Liberalism, Military, National Debt, Political Correctness, Political Corruption, Populism, Progressive Movement, Socialism, Totalitarian, Transparency, U.S. Presidents, Wokeness | No Comments »

Saturday, March 9th, 2024

Unbelievable that our own government is actively destroying our country ! This video goes into detail about exactly how our government is giving incredible benefits to these illegals that they are secretly flying into our country ! Prepare yourself, this is not going to end well. Nancy P.S. There is not a Skip Ad button to the video so we have to endure the commercial before the video begins

Elon Musk Issues ‘9/11’ Warning; 320,000 Illegal Immigrants Secretly Flown Into US

The federal government has now admitted that it has been actively flying illegal immigrants directly into the United States. So far, it has facilitated air travel for 320,000 illegal immigrants. This is in addition to the others who travel to the U.S.–Mexico border and surrender themselves to authorities to enter the amnesty system. Behind this program is a government app that is gaining more attention, known as CBP One, and allows migrants to schedule appointments with U.S. authorities to illegally enter the United States.

In this live Q&A with Crossroads host Joshua Philipp, we’ll discuss this topic and others, and answer questions from the audience.

Posted in 9/11, Administrative State, Big Government, Child Endangerment, Congress, Constitution, Corruption/Crime, Cultural Marxism, Culture Rot, Cyber Security, Deep State, Democracy, Democrats, Dept of Defense, Dictators, Diversity, Donald Trump, Economy, Election, Election 2024, Electoral College, Entitlements, FBI, Foreign Policy, Globalists, Globalization, GOP, Grassroots, Great Reset, Gun Control, Hamas, Hezbollah, Illegal Immigration, Intelligence, ISIS Terror Group, Islamic Refugee Migration, Jihad, Joe Biden, Kamala Harris, Legal Issues, Liberalism, Marxism, Media, Mexico, Middle East, Migration - Islamic, Multiculturalism, Muslim Brotherhood, National Defense, Obama, Obama Administraiton and Policy, Open Borders, Police/law enforcement, Political Correctness, Political Corruption, Politics, Progressive Movement, Radical Islam, Radical Left, Sanctuary Cities, Socialism, South America, Sovereignty, Terrorism, Texas, Totalitarian, Transparency, Videos, Voter Fraud, Wokeness, Women's Issues | No Comments »

Wednesday, November 8th, 2023

If you wondered how all the millions of illegal migrants arrive at our southern border, well fed and well clothed after traveling thousands of miles, this video exposes how the various organizations such as Doctors Without Borders, The Red Cross and many other organizations make it possible for millions of people to arrive at our southern border. The plan, part of Agenda 2030, is to change the demographics of the United States into a Socialist country. Please share with all your contacts and ask them to remember this video when they vote in 2024. We, the citizens of this country, are being replaced ! Nancy

A MUST WATCH VIDEO – A ROAD MAP TO THE U.S. VIA SOUTH AMERICA

Posted in Administrative State, Afghanistan, Africa, Agenda 2030, Agenda 21, Asia, Big Business, Big Government, Border Security, CAIR, Caliphate, Charities, Child Endangerment, China, Class Warfare, Cloward-Piven, Corruption/Crime, Cultural Marxism, Culture Rot, Deep State, Democracy, Democrats, Demographics, Diversity, Donald Trump, Drug Smuggling, Economy, Education, Election 2024, Elitism, Entitlements, Environmental Issues, Foreign Policy, Global Warming, Globalists, Globalization, GOP, Government Regulation, Government Waste and Fraud, Hamas, Hezbollah, Illegal Immigration, Intelligence, International Affairs, Iran, Islamic Refugee Migration, Jihad, Joe Biden, Justice Department, Kamala Harris, Legal Issues, Liberalism, MAGA, Marxism, Media, Mexico, Middle East, Migration - Islamic, Multiculturalism, National Defense, Nationalism, Obama, Obama Administraiton and Policy, Open Borders, Political Correctness, Political Corruption, Politics, Progressive Movement, Radical Islam, Radical Left, Sanctuary Cities, Social Justice, Socialism, South America, Sovereignty, State Department, Sustainability, Terrorism, Totalitarian, Transparency, U.S. Presidents, Videos, Wokeness, World Economic Forum | No Comments »

Sunday, November 5th, 2023

Our country is up for grabs to whoever and however they can get here. If the Biden administration wanted more immigrants, all they would have to do is legally increase the quotas that are allowed from nations around the world. Then we would know who is coming into our country and why. These millions of illegals are jumping in front of people from all over the world who are patiently doing it the right way as our ancestors did. This flood of millions of illegal migrants is a recipe for the destruction of our country. This is part of the Cloward/Piven Strategy – overwhelm the system until it collapses and then rebuild it the way you want it to be which is Socialism – which is the first step to Communism. All this will be accomplished on the American taxpayers’ dime. We will be paying for these illegals to be fed, housed, educated, and given medical coverage. Biden and the entire Democrat Party are responsible for this disaster. Please remember that when you vote in 2024 ! Nancy

Migrants Are Flocking to the U.S. From All Over the Globe

Arrests at the Southwest border of migrants from China, India and other distant countries have tripled

Hundreds of thousands of migrants from all over the world are making their way to the Southwest border, with U.S. and Mexican authorities reporting a surge in apprehensions of people from Asia and Africa as human smuggling networks widen their reach across the globe.

Arrests at the Southwest border of migrants from China, India and other distant countries, including Mauritania and Senegal, tripled to 214,000 during the fiscal year that ended in September from 70,000 in the previous fiscal year, according to U.S. Customs and Border Protection data. Fewer than 19,000 migrants from Asia and Africa were apprehended in the fiscal year ended September 2021.

“The increase in migration from Asia and Africa is remarkable,” said Enrique Lucero, head of the migrant support unit of the Tijuana city government, across from San Diego. “These days, we are dealing with 120 nationalities and 60 different languages.”

(more…)

Posted in Administrative State, Afghanistan, Africa, Asia, Big Business, Big Government, Border Security, Charities, Child Endangerment, China, Cloward-Piven, Community Organizers, Congress, Corruption/Crime, Culture Rot, Deep State, Democracy, Democrats, Demographics, Diversity, Economy, Education, Election 2024, Entitlements, Foreign Policy, George Soros, Globalists, Globalization, GOP, Government Waste and Fraud, Illegal Immigration, International Affairs, Iran, Islamic Refugee Migration, Jihad, Joe Biden, Justice Department, Kamala Harris, Legal Immigration, Legal Issues, Liberalism, MAGA, Marxism, Middle East, Migration - Islamic, Multiculturalism, National Defense, Obama, Obama Administraiton and Policy, One World Government, Open Borders, Pakistan, Political Correctness, Political Corruption, Politics, Progressive Movement, Protestors, Radical Islam, Radical Left, Sanctuary Cities, Social Justice, Socialism, Soros, Terrorism, Transparency, Tyranny, Wokeness, Women's Issues, World Economic Forum | No Comments »

Saturday, November 4th, 2023

600,000 illegal gotaways who border agents were unable to apprehend just this year. Let that number sink in. Who are they ? where are they? Are they a terrorist threat ? It took only 19 Islamist terrorists to kill nearly 3,000 innocent people on Sept 11. Don’t take the safety of you and your family for granted. Be vigilant Nancy

Alejandro Mayorkas admits 600,000 illegal ‘gotaways’ crossed border in 2023, calls immigration system ‘broken’

Posted in Administrative State, Big Government, Border Security, CAIR, Corruption/Crime, Cultural Marxism, Deep State, Democracy, Democrats, Demographics, Diversity, Economy, Education, Election 2024, Entitlements, FBI, FBI Director, Foreign Policy, Globalists, Globalization, Government Waste and Fraud, Hamas, Hezbollah, ISIS Terror Group, Jihad, Joe Biden, Kamala Harris, Legal Issues, Mexico, Migration - Islamic, Obama, Obama Administraiton and Policy, Open Borders, Political Correctness, Political Corruption, Politics, Progressive Movement, Radical Left, Sanctuary Cities, South America, Sovereignty, Transparency, Wokeness, Women's Issues | No Comments »

Saturday, October 14th, 2023

TUCKER CARLSON – ILLEGAL IMMIGRATION CRISIS – OCTOBER 12, 2023

Posted in Africa, Big Business, Big Government, Border Security, Charities, Cloward-Piven, Congress, Corruption/Crime, Cuba, Deep State, Democracy, Democrats, Demographics, Diversity, Donald Trump, Economy, Egypt, Election, Election 2020, Election 2024, Entitlements, Europe, Foreign Policy, Globalists, Globalization, Government Waste and Fraud, Illegal Immigration, Joe Biden, Kamala Harris, Legal Immigration, Legal Issues, Liberalism, Middle East, Migration - Islamic, National Defense, Nationalism, Obama, Obama Administraiton and Policy, Open Borders, Political Correctness, Political Corruption, Politics, Progressive Movement, Radical Left, Sanctuary Cities, Social Justice, Socialism, South America, Sovereignty, Terrorism, Transparency, Tucker Carlson, Turkey, U.S. Presidents, Videos, Welfare, Wokeness, Women's Issues | No Comments »

Saturday, September 9th, 2023

NYC Mayor Eric Adams Says Illegal Immigration Will Destroy The City – That Was The Point Eric

By Sam Faddis September 8, 2023

“Let me tell you something New Yorkers, never in my life have I had a problem that I did not see an ending to — I don’t see an ending to this,” New York Mayor Eric Adams said Wednesday night in his opening remarks at a town hall-style gathering in Manhattan. “This issue will destroy New York City.”

The Mayor is right. What he does not seem to comprehend, however, is that that is the entire point of this administration’s immigration policies. It is to destroy America as we know it. This government is not run by individuals looking to serve the population of the United States and safeguard its citizens. It is, at the upper levels, run by radicals who despise this country and everything it stands for and are looking to radically restructure it along clearly Marxist lines.

This government’s official policy is not to control the border or the flow of migrants into this country. The official policy of this government is to guarantee “safe and orderly migration.”

“The Biden-Harris Administration is committed to safe, orderly, and humane migration around the world, including to the United States. We commit to working with other countries to enhance cooperation to manage migration in ways that are grounded in human rights, transparency, non-discrimination, responsibility-sharing, and State sovereignty.”

state.gov

The illegals from all over the planet that are destroying New York and so much of the rest of our country are not just somehow managing to find their way here. They are being moved across Central America on what amounts to a conveyor belt of camps, often linked by contract bus service, run by a wide range of non-profits. Much of the funding for all this comes from the U.S. Government.

You are paying to bring these people here. And, then you are paying to maintain them once they arrive. You are being replaced, and you are footing the bill for the entire operation.

PLEASE CLICK ON THE ABOVE LINK TO READ THE ENTIRE ARTICLE AND TO VIEW SEVERAL VIDEOS THAT ARE IN THE ARTICLE

Posted in Administrative State, Agenda 2030, Agenda 21, Big Business, Big Government, Border Security, California, Child Endangerment, China, Class Warfare, Community Organizers, Corporate Cronyism, Corruption/Crime, Cultural Marxism, Deep State, Democracy, Democrats, Demographics, Department of Education, Dept of Defense, Diversity, Education, Election, Election 2024, Elitism, Entitlements, Environmental Issues, Equity, Europe, Food Stamps, Foreign Policy, George Soros, Germany, Global Warming, Globalists, Globalization, Government Regulation, Government Waste and Fraud, Great Reset, Identity Politics, Illegal Immigration, Intelligence, Islamic Refugee Migration, Jihad, Joe Biden, Justice Department, Kamala Harris, Legal Immigration, Legal Issues, Liberalism, Marxism, Mexico, Middle East, Migration - Islamic, National Defense, Nationalism, NPR - National Public Radio, Obama, Obama Administraiton and Policy, One World Government, Open Borders, Pelosi, Political Correctness, Political Corruption, Politics, Racism, Radical Islam, Radical Left, Redistribution of Wealth, Sanctuary Cities, Secular Democrats of America, Social Justice, Socialism, Soros, Spending, State Department, State Governments / Deficits, Taxation, Taxes, Terrorism, Totalitarian, Transparency, Tyranny, U.S. Presidents, Videos, Wokeness, Women's Issues, World Economic Forum | No Comments »

Friday, September 8th, 2023

WHAT THE LEFT DID TO OUR COUNTRY

September 4, 2023

In the last 20 years, the Left has boasted that it has gained control of most of America institutions of power and influence—the corporate boardroom, media, Silicon Valley, Wall Street, the administrative state, academia, foundations, social media, entertainment, professional sports, and Hollywood.

With such support, between 2009-17, Barack Obama was empowered to transform the Democratic Party from its middle-class roots and class concerns into the party of the bicoastal rich and subsidized poor—obsessions with big money, race, a new intolerant green religion, and dividing the country into a binary of oppressors and oppressed.

The Obamas entered the presidency spouting the usual leftwing boilerplate (“spread the wealth,” “just downright mean country,” “get in their face,” “first time I’ve been proud of my country”) as upper-middle-class, former community activists, hurt that their genius and talents had not yet been sufficiently monetized.

Posted in Administrative State, Afghanistan, Agenda 2030, Agenda 21, American History, Anti-Capitalists, Antifa, Big Business, Big Government, Black Lives Matter, Border Security, Cancel Culture, Censoring, CIA, Class Warfare, Cloward-Piven, Community Organizers, Congress, Corporate Cronyism, Corruption/Crime, Critical Race Theory, Cultural Marxism, Culture Rot, Deep State, Democracy, Democrats, Department of Education, Dept of Defense, Diversity, Donald Trump, Durham Report, Education, Election 2020, Election 2022, Election 2024, Elizabeth Warren, Energy, Entitlements, Environmental Issues, Environmental Protection Agency-, Equity, Fascism, FBI, FBI Director, George Soros, Globalists, Globalization, GOP, Government Regulation, Government Waste and Fraud, Great Reset, Green New Deal, Healthcare, Hillary Clinton, Illegal Immigration, Indoctrination of students, Industrial Areas Foundation (IAF), Inflation, Intelligence, International Affairs, Iran, Iran Nuclear Deal, IRS, James Comey, January 6 Capitol Hill Event, Joe Biden, John Brennan, Judges, Justice Department, Kamala Harris, Legal Issues, LGBTQ, Liberalism, MAGA, Marxism, Multiculturalism, National Debt, National Defense, NPR - National Public Radio, Obama, Obama Administraiton and Policy, Obamacare, One World Government, Open Borders, Police/law enforcement, Political Correctness, Political Corruption, Politics, Progressive Movement, Racism, Radical Left, Regulations, Resistance, Same Sex Marriage, Sanctuary Cities, Saul Alinsky, Secular Democrats of America, Securlarism, Social Issues, Social Justice, Socialism, Soros, Spending, State Department, Sustainability, Totalitarian, transgender issues, Transparency, Tyranny, U.S. Presidents, Victor Davis Hanson, Voter Fraud, White Privilege, WHO - World Health Organization, Wokeness, Women's Issues, World Economic Forum | No Comments »

Tuesday, August 8th, 2023

Read and weep for our country. Nancy

10 ways American culture and way of life is under assault

August 7, 2023

Posted in Administrative State, Agenda 2030, Agenda 21, American History, Anti-Capitalists, Big Business, Big Government, Bill Ayers, Black Lives Matter, Border Security, California, Cancel Culture, Censoring, Child Endangerment, Class Warfare, Clinton Foundation, Cloward-Piven, Community Organizers, Congress, Conservatism, Corporate Cronyism, Corruption/Crime, Critical Race Theory, Cultural Marxism, Culture Rot, Deep State, Democracy, Democrats, Demographics, Dept of Defense, Diversity, Donald Trump, Drug Smuggling, Drug War, Durham Report, Election, Election 2020, Election 2024, Elitism, Energy, Entitlements, Environmental Issues, Environmental Protection Agency-, Equity, FBI, FBI Director, FDA, FISA Court, Free Speech, Global Warming, Globalists, Globalization, GOP, Government Regulation, Government Waste and Fraud, Great Reset, Green New Deal, Gun Control, Hunter Biden, Identity Politics, Illegal Immigration, Industrial Areas Foundation (IAF), Intelligence, IRS, January 6 Capitol Hill Event, Joe Biden, Judges, Justice Department, Kamala Harris, Legal Issues, Liberalism, MAGA, Marxism, Media, Military, Mueller, National Debt, National Defense, Obama, Obama Administraiton and Policy, Oil Industry, One World Government, Open Borders, Pelosi, Police/law enforcement, Political Correctness, Political Corruption, Politics, Progressive Movement, Racism, Radical Left, Regulations, Resistance, Social Issues, Social Justice, Social Media, Socialism, Sovereignty, State Department, Totalitarian, Transparency, Tyranny, Victor Davis Hanson, Wokeness, World Economic Forum | No Comments »

Tuesday, June 20th, 2023

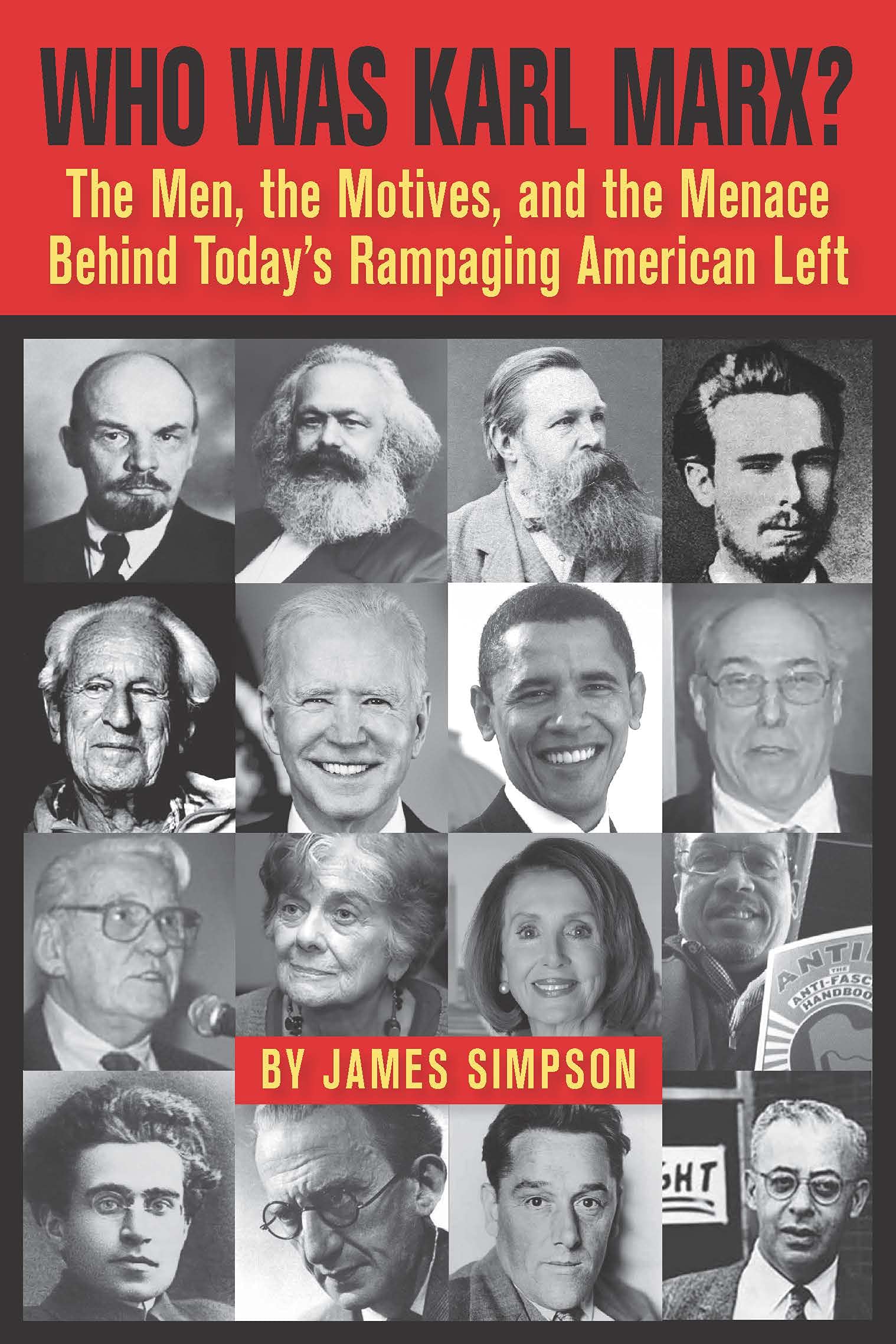

The following books by James Simpson are must reads in understanding how the Far Left Marxists are attempting to destroy our country. Below you will find a brief description of 6 of the books written by James Simpson. Nancy

WHO IS JAMES SIMPSON ?

James Simpson is an investigative journalist, businessman and former economist and budget examiner for the White House Office of Management and Budget (OMB).

Since 1995, he has written non-fiction articles for various periodicals based both on his experiences in government and business, and a longstanding interest in public policy.

Mr. Simpson is best known for his exposé on the Cloward-Piven Strategy of Manufactured Crisis. His work provided background for Glenn Beck’s TV series on the subject. He is featured in Curtis Bowers’ award winning documentary “AGENDA: Grinding America Down,” Trevor Loudon’s “The Enemies Within,” and “Enemies Within the Church,” and is a frequent guest on radio and TV talk shows.

Mr. Simpson’s work has been published in the Washington Times, WorldNet Daily, The Federalist, American Thinker, Accuracy in Media, Breitbart, Daily Caller, Center for Security Policy and many others. His website is www.crisisnow.net

BOOKS BY JAMES SIMPSON

www.amazon.com/stores/James%20Simpson/author/B00I5W3VVA

Posted in Acorn, Administrative State, Agenda 2030, Agenda 21, American History, Anti-Capitalists, Bernie Sanders, Big Government, Bill Ayers, Black Lives Matter, Book Reviews, Cancel Culture, Censoring, Child Endangerment, China, CIA, Class Warfare, Cloward-Piven, Common Core Curriculum, Community Organizers, Congress, Corruption/Crime, Cuba, Cultural Marxism, Culture Rot, Deep State, Democracy, Democrats, Demographics, Dept of Defense, Dictators, Diversity, Donald Trump, Drug War, Durham Report, Economy, Education, Election, Election 2016, Election 2018, Election 2020, Election 2022, Election 2024, Elitism, Elizabeth Warren, Energy, Entitlements, Environmental Issues, Environmental Protection Agency-, Equity, Fascism, FBI, FBI Director, FDR, Feminism, Frankfurt School, Franklin Roosevelt, Free Speech, George Soros, Glenn Beck, Global Warming, Globalists, Globalization, GOP, Government Waste and Fraud, Grassroots, Great Reset, Green New Deal, Gun Control, History, Hugo Chavez, Identity Politics, Illegal Immigration, Indoctrination of students, Industrial Areas Foundation (IAF), Intelligence, Islamic Refugee Migration, James Comey, January 6 Capitol Hill Event, Joe Biden, John Brennan, Justice Department, Legal Issues, LGBTQ, Liberalism, Linda Sansour, MAGA, Marxism, Media, Military, Multiculturalism, National Defense, Nationalism, Nazism, NPR - National Public Radio, Obama, Obama Administraiton and Policy, One World Government, Open Borders, Pelosi, Political Correctness, Political Corruption, Politics, Progressive Movement, Protestors, Putin, Racism, Radical Left, Redistribution of Wealth, Refugee Resettlement Watch - Ann Corcoran, Regulations, Resistance, Rules For Radicals, Russia, Russian Reset, Saul Alinsky, Securlarism, Social Issues, Social Justice, Socialism, Soros, Southern Poverty Law Center, Sovereignty, State Department, Sustainability, Tea Party, Totalitarian, transgender issues, Transparency, Tyranny, U.N., UN Agenda 2030, Unions, Voter Fraud, White Privilege, Wokeness, Women's Issues, World Economic Forum | No Comments »